nevada estate tax rate

The Texas state sales tax rate is 625 and the average TX sales tax after local surtaxes is 805. Groceries prescription drugs and non-prescription drugs are exempt from the Texas sales tax.

Taxes In Nevada U S Legal It Group

For the most part Use Tax rather than Sales Tax applies to property purchased ex-tax outside of Nevada for storage use or other consumption in Nevada from other than a seller registered in Nevada.

. The United States has gift tax treaties either separate or in combination with estate tax treaties with the following countries. The Nevada state sales tax rate is 685 and the average NV sales tax after local surtaxes is 794. Counties and cities can charge an additional local sales tax of up to 125 for a maximum possible combined sales tax of 81.

Counties and cities can charge an additional local sales tax of up to 2 for a maximum possible combined sales tax of 825. Texas has 2176 special sales tax jurisdictions with local. Gift taxes under the Code.

Nevada has 249 special sales tax jurisdictions with local sales taxes in. Nevada has the 13th highest combined average state and local sales tax rate in the US according to the Tax Foundation. These treaties may eliminate the US.

Groceries and prescription drugs are exempt from the Nevada sales tax. Creighton said any digital goods tax needs to be equitable because its about taxing a product digitally at the same rate whether you are buying a book in a local shop or digitally. Explore our list below to see the 10 states with the lowest property taxes by their average effective property tax rate.

For instance Louisiana currently has the fifth-lowest property tax rate in the US. Nevada has a 685 percent sales tax rate and a max local rate of 153 percent with an average combined state and local sales tax rate of 823 percent. Nevada State Sales Tax.

But the state makes up for this with a higher-than-average sales tax. And at 4 it also has one of the lowest sales taxes in the country as well while its state income taxes range between 2 and 6. Use Tax applies to mail order out-of-state toll-free 800 numbers purchases made on the internet and other purchases of tangible personal.

The general sales tax rate in Nevada is 685 percent statewide but it does vary by county as some impose a local sales tax as well. Gift tax on certain transfers that are otherwise subject to US.

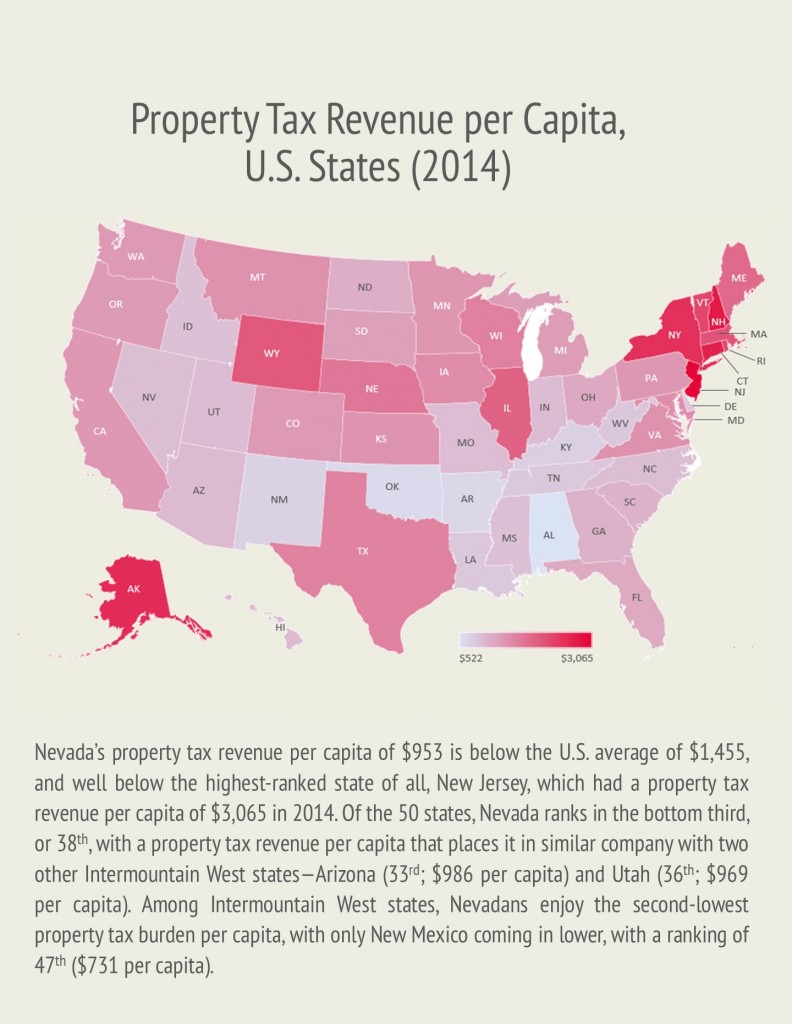

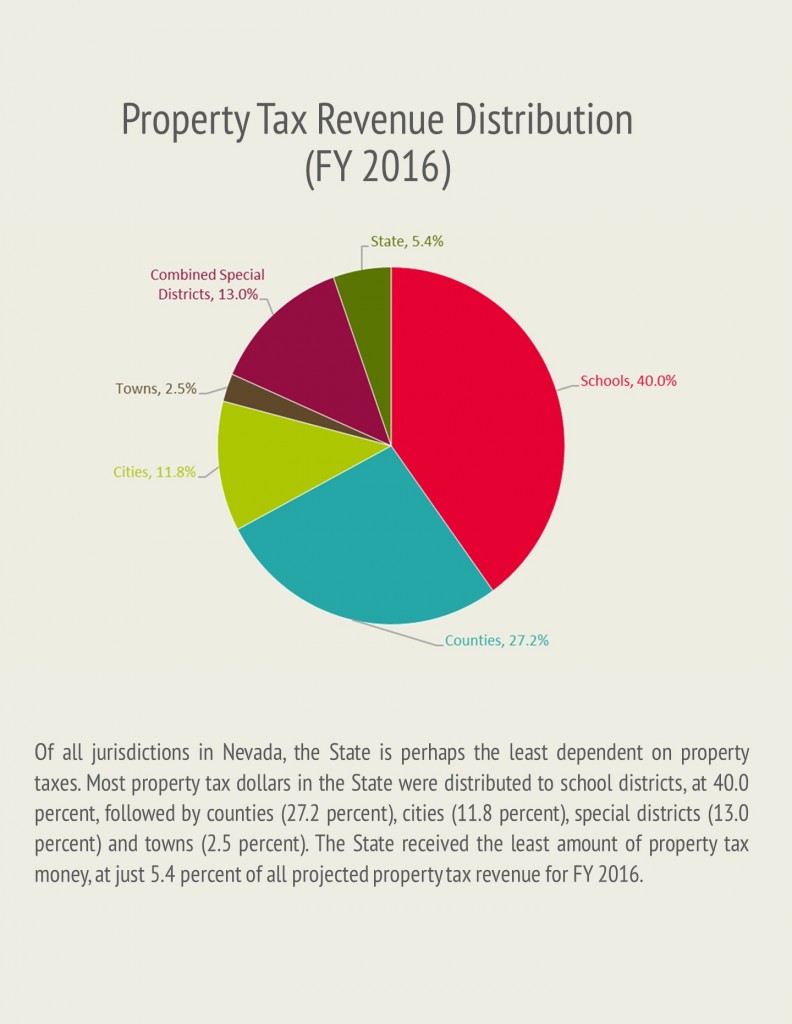

Property Taxes In Nevada Guinn Center For Policy Priorities

City Of Reno Property Tax City Of Reno

States With The Highest And Lowest Property Taxes Property Tax Tax States

States Where Residents Are Most Satisfied Estate Tax Inheritance Tax Inheritance

Property Taxes In Las Vegas Nv The Cramer Group At Urban Nest Realty

Property Taxes In Nevada Guinn Center For Policy Priorities

Taxes In Nevada U S Legal It Group

Nevada Vs California Taxes Explained Retirebetternow Com

Nevada Tax Rates Rankings Nevada State Taxes Tax Foundation

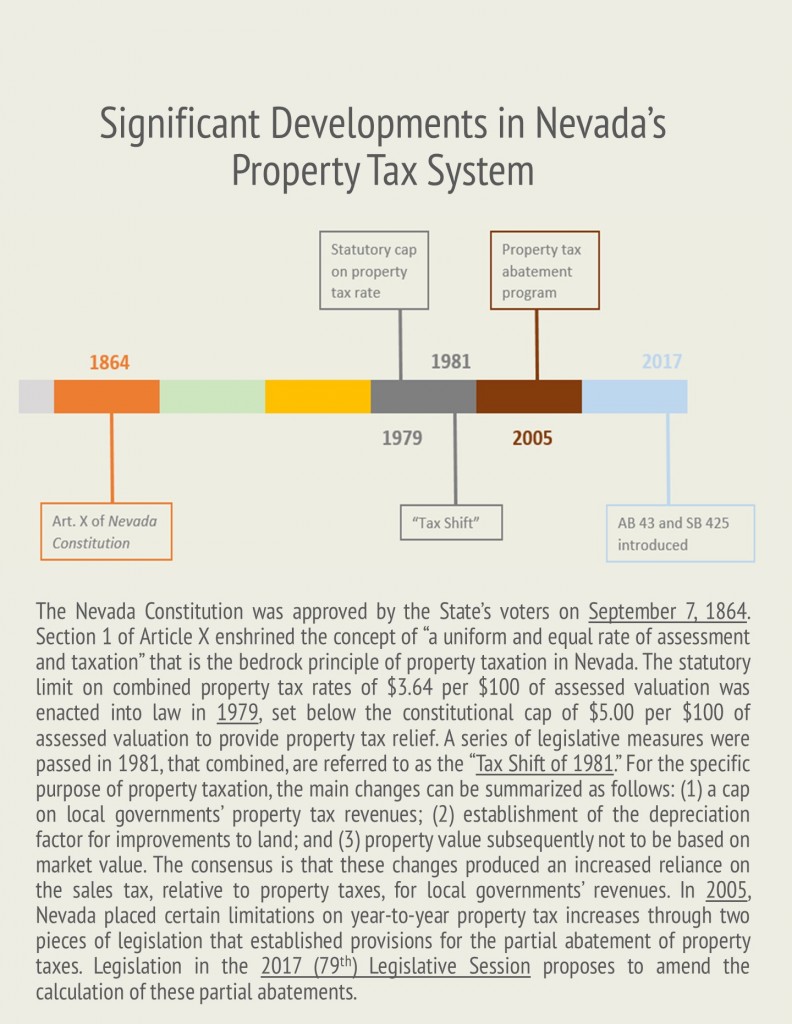

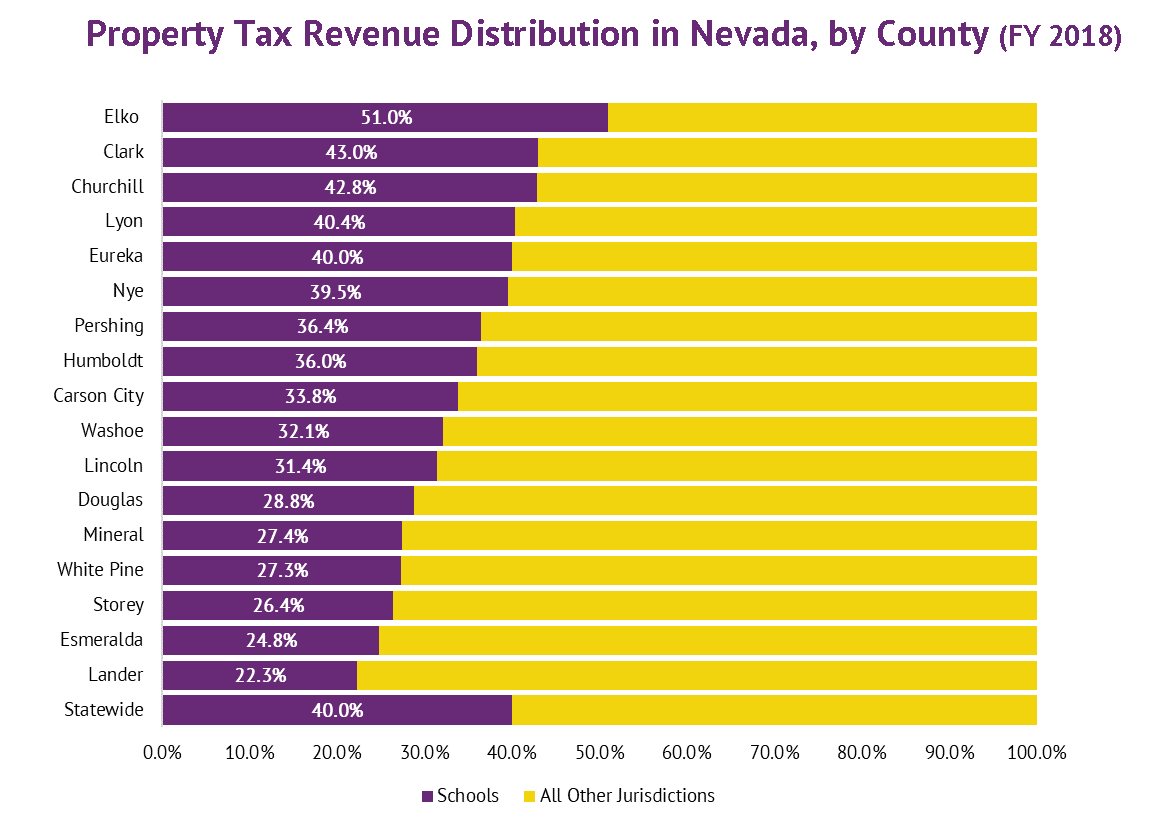

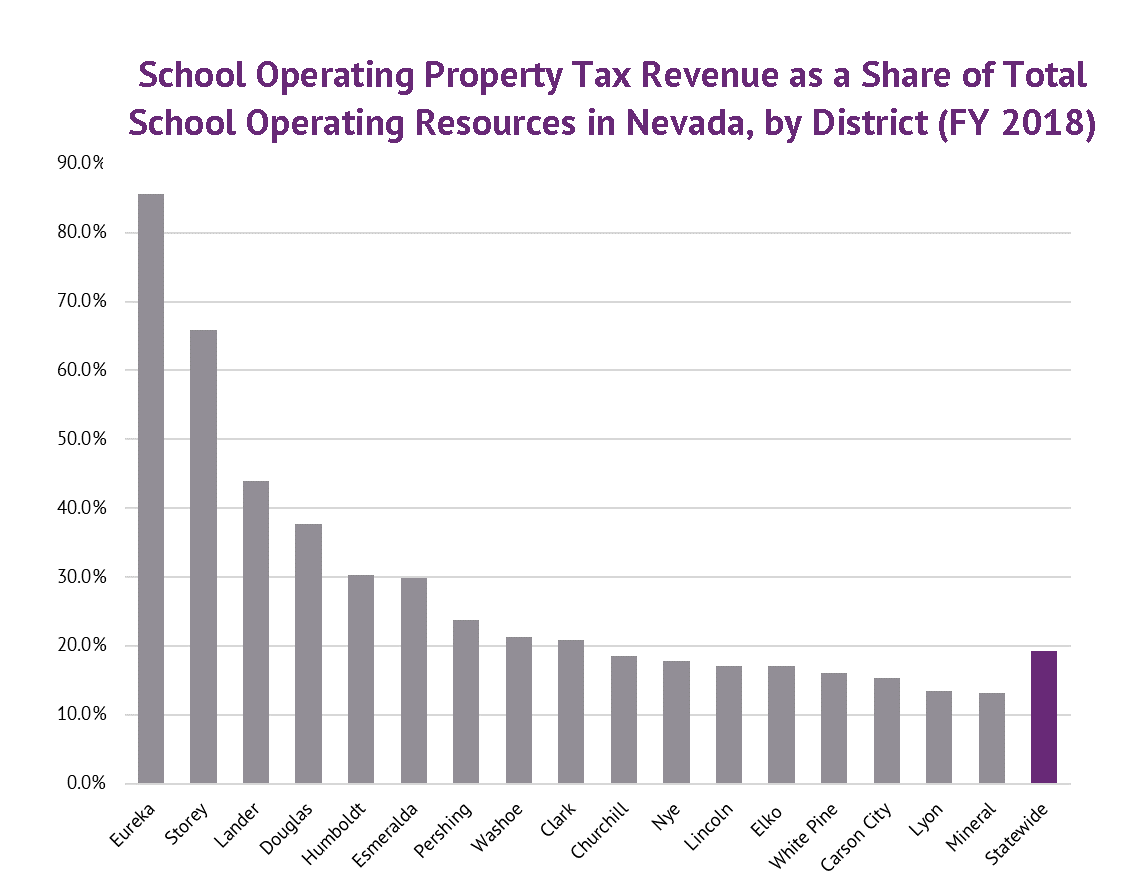

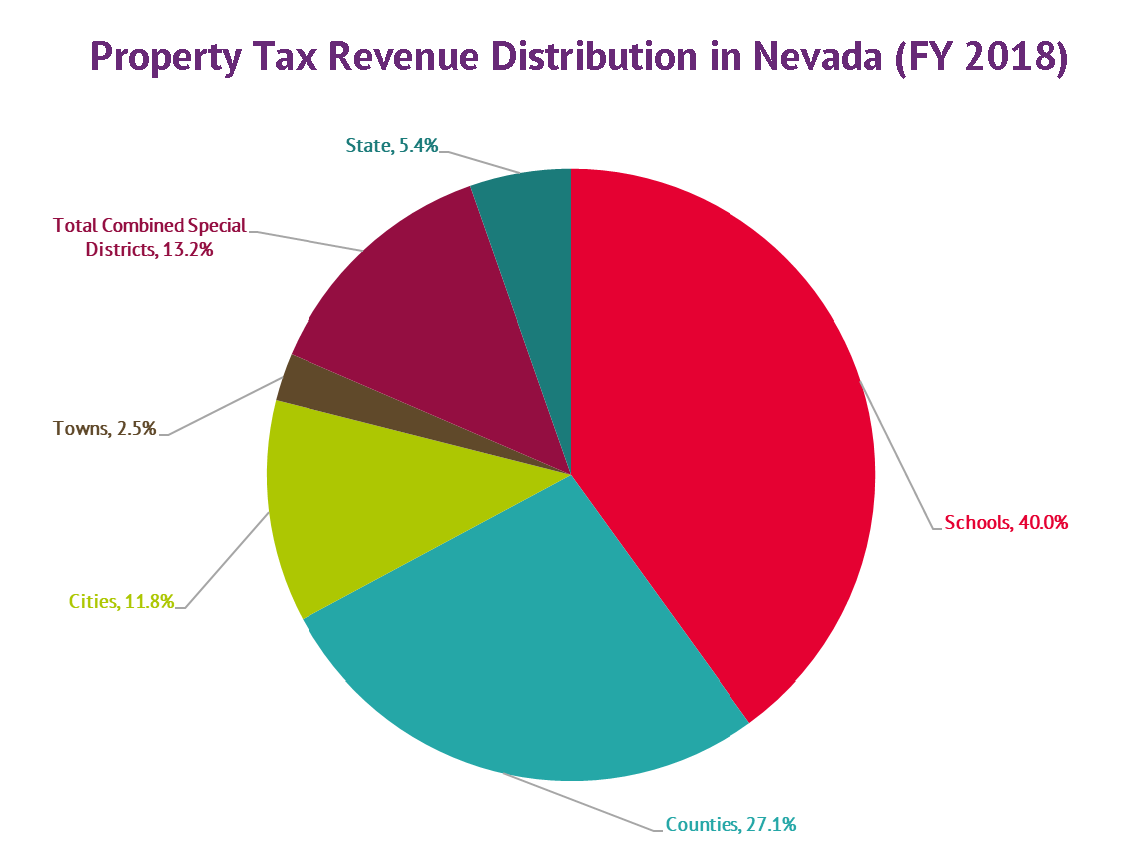

Property Taxes K 12 Financing In Nevada Guinn Center For Policy Priorities

Property Taxes K 12 Financing In Nevada Guinn Center For Policy Priorities

Property Taxes K 12 Financing In Nevada Guinn Center For Policy Priorities

Nevada Property Tax Calculator Smartasset

Property Taxes In Nevada Guinn Center For Policy Priorities

Nevada Inheritance Laws What You Should Know

Nevada Tax Rates And Benefits Living In Nevada Saves Money

Taxpayer Information Henderson Nv

Congrats To My Relocation Clients Moving Back To Stl From Nv Who Just Closed On This Cutie In Ste Gen I Am Super Excited For T In 2022 House Styles Realtors Realty