oke stock dividend payout

Ad Our Strong Buys Double the SP. Best dividend capture stocks in Apr.

7 Dividend Growth Stocks For November 2021 Dividend Strategists

The closing price during Jan 28 2021 was 4211.

. And the median was 479. While I understand that it offers a. 523 Typical ex-date schedule.

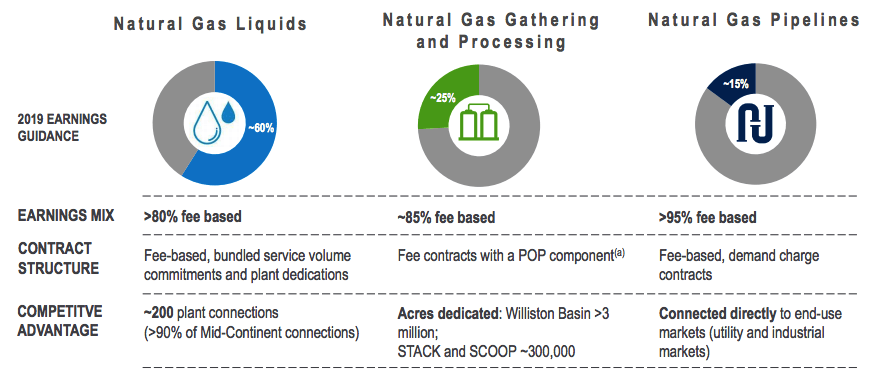

Dividend Yield and Dividend History Highlights. OKE dividend growth history. Average dividend growth rate for stock ONEOK Inc.

Quarterly Last known quarterly dividend. 35 minutes agoKinetiks dividend payout ratio DPR is presently 11696. OKE on 01-19-2022 declared a dividend of 09350 per share.

OKE Next Dividend Date Projection Last known ex-date. ONEOKs next dividend payment date is on 2022-05-16 when ONEOK shareholders who owned OKE shares before 2022-04-29 will receive a dividend payment of 09350 per share. ONEOK has an investment-grade credit rating of BBB-Baa3.

At the current share price OKE is yielding 58. The company has not cut its dividend in the last twenty-five years and more. Add OKE to your watchlist to be reminded of.

At the current share price OKE is yielding 58. There are typically 4 dividends per year excluding specials and the dividend cover is approximately 09. As for free cash flow OKE has greater average cash flow over the past 55 years than 583 US-listed dividend payers.

August 1st the typical date would have fallen on a. ONEOKs Dividends per Share for the months ended in Dec. ONEOK pays a 374 annual dividend.

Dividend will go ex in 5 days for 935c and will be paid in 22 days. ONEOK has a dividend yield of 571 and paid 374 per share in the past year. This annual dividend was paid in 2020 and 2021 and is forecasted for 2022.

OKE for past three years is 491. ONEOK Dividend Information. Expand Research on OKE.

Dividend was 935c and it went ex 3 months ago and it was paid 2 months ago. OKEs next dividend payment. ONEOKs Dividends per Share for the months ended in Dec.

Based On Fundamental Analysis. ONEOK raises dividend 21 to 0745 quarterly. Assume you had bought 1000 worth of shares before one year on Jan 28 2021.

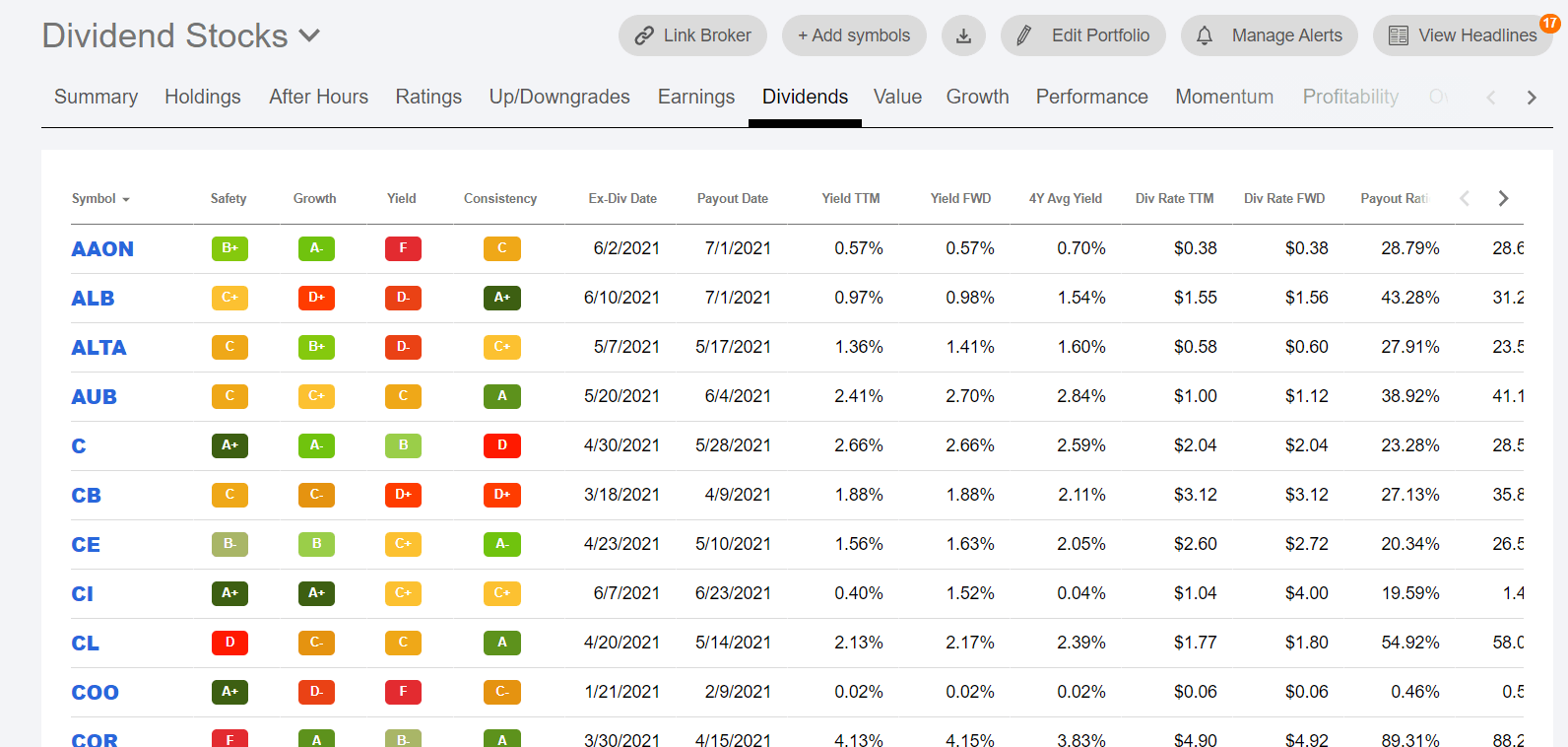

Predicted Next Dividend Ex-Date For OKE. 43 rows Ticker. The dividend payout ratio for OKE is.

ONEOK Inc Dividend Stock News and Updates. The forward dividend yield for OKE as of April 20 2022 is 518. ONEOK pays a 374 annual dividend.

And the median was 479. Payout Ratio FWD Fwd Payout Ratio is used to examine if a companys earnings can support the current dividend payment amount. The lowest was 235.

The lowest was 235. 012822 Last known frequency. This annual dividend was paid in 2020 and 2021 and is forecasted for 2022.

The previous Oneok Inc. 9257 based on next years estimates. Average Dividend Yield.

During the past 13 years the highest Trailing Annual Dividend Yield of ONEOK was 1744. Declare date ex-div record pay frequency amount. OKE reports less variability in its cash flow than 432 of dividend stocks in our set.

OKE on 10-20-2021 declared a dividend of 09350 per share. During the past 3 years the average Dividends Per Share Growth Rate was 480 per year. The dividend is paid every three months and the next ex-dividend date is Apr 29 2022.

9868 based on this years estimates. OKE currently pays investors 374 per share or 508 on an annual basis. ONEOK Inc OKE paid a dividend of 0935 per share on Jan 28 2022.

By month or year chart. In related news major shareholder Corp Apache sold 4000000 shares of. 6190 Annualized Dividend.

OKE as of April 20 2022 is 374 USD. Regarding free cash flow variation. 11131 based on the trailing year of earnings.

61 rows The next Oneok Inc. Find the latest dividend history for ONEOK Inc. Investors are asked to pay 12x EBITDA minus capex.

Average Dividends per Year. 19 2022 DIVIDEND ANNOUNCEMENT. As of today 2022-04-23 the Dividend Yield of ONEOK is 540.

374 Dividend Yield. During the past 5 years the average Dividends Per Share Growth Rate was 940 per year. 20 2021 DIVIDEND ANNOUNCEMENT.

All in all this is a reasonably attractive investment. The company increased its dividend 10 times in the past 5 years and its payout has grown 683 over the same time period. For 1000 you would have purchased 23 number of shares.

Average Annual Dividend Yield. This current yield is higher than the decade average of 53. 7863 based on cash flow.

0935 Expected annual yield. 150 rows The current dividend payout for stock ONEOK Inc. In terms trailing twelve months of dividends issued OKE has returned 1634928000 US dollars -.

Oneok Inc Oke Dividend Stock Analysis Dividend Growth Investor

80 High Yield Dividend Large Cap Stocks Dividend Stocks Dividend Investing Dividend

Dividend Stocks What They Are And The Top Performers Gobankingrates

If You Like Dividends You Should Love These 3 Stocks The Motley Fool

Oke Dividend History Ex Date Yield For Oneok

Top 12 Reliable Stocks That Pay Monthly Dividends Dividend Dividend Income Dividend Stocks

Oke Dividend History Ex Date Yield For Oneok

Oke Dividend Date History For Oneok Inc Dividend Com

Oneok Inc Oke Dividend Stock Analysis Dividend Growth Investor

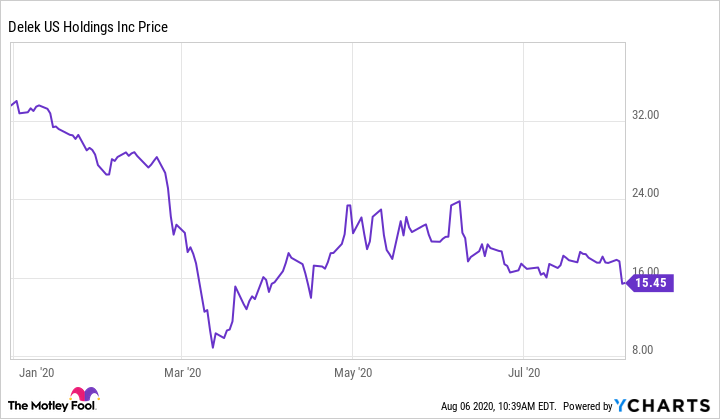

Danger Lurks For These 3 High Yield Dividend Stocks The Motley Fool

Oneok Inc Oke Dividend Stock Analysis Dividend Growth Investor

Find Safe Dividend Stocks For Your Portfolio

If You Like Oneok Inc S Dividend You Should Love Williams Companies Payout The Motley Fool

Oneok A Dividend Stock Worth Buying Nyse Oke Seeking Alpha

Dividend Yield Stock Capital Investment 25 Best Yielding Master Limited Partnerships Mlps Limited Partnership Best Investments Dividend Stocks

Identify Solid Dividend Stocks And Juice Your Income With Seeking Alpha Seeking Alpha

2022 High Dividend Stocks List Highest Yields Up To 17 1